How Orthodontic Branding can Save You Time, Stress, and Money.

, is the approach of putting pertinent key words within your internet site content to be more quickly discovered by a search engine. The keyword phrases are efficiently added you are provided a much better possibility at being spotted by somebody searching for your field of work.

To fully enhance your search engine optimization you have to take into account all the needed aspects. Material, framework, and accounts are taken into consideration for your search engine optimization position. Ease of navigation is necessary also so that patients are a lot more quickly able find what it was they were searching for. By making use of keyword phrases fully, you have the ability to spread the word of your practice through search engine or social networks.

The Only Guide for Orthodontic Branding

Your directory of products will certainly be promoted extra conveniently, and therefore sold to any interested celebration who has the ability to see the sale. With the social media phenomenon being so widespread, why not profit on your own? Mobility has become a keyword in the new digital age. Exactly how accessible your site is on the go corresponds to how willing people will certainly be to see it.

The electronic media systems you will certainly require to access in order to have an effective orthodontic advertising campaign typically have mobile gain access to as a requisite. 30% of all U (Orthodontic Branding). S commerce is mobile. (Internet Seller, 2015) There are 2.6 billion smart device users around the world, with a predicted 6.1 billion users by 2020

(Google, 2016) 34% of on-line retail sales now happen on mobile devices. (Google, 2016) Regional existence counted heavily on on-line presence, and what individuals claim. Just as word of mouth is qualified of making or damaging a company, online reviews are able to do so. People are consulting their phones when buying choice more than ever.

3 Simple Techniques For Orthodontic Branding

The success of an advertising and marketing campaign depends on the ROI results, which reveal simply how well the project went. With reasonable objectives tempered by our marketing and Search engine optimization methods your ROI will reach optimal degrees.

There is no point to an advertising and marketing campaign if the results appear hurried, and ROI is reliant on quality outcomes. The time required for an advertising and marketing project depends of various aspects like: Former search engine optimization work, web content, website condition and age. The elements readily available are considered to ensure that your marketing project balance quality and speed appropriately.

An orthodontist marketing campaign should have a defined area, which allows for neighborhood marketing to reach people in the location and bordering areas much more easily. On-line presence relies heavily on brand-new details, to have people understand your company they should know that the info they are obtaining is updated. With count on and location protected, your earnings sees a rise as your services come to be sought.

9 Simple Techniques For Orthodontic Branding

On The Map Advertising operates in the area of enhancing your online presence on the numerous digital platforms readily available. However your web site takes the very first top priority in exactly how you will certainly obtain and communicate with potential clients. We deal with you to create an on-line page that fits your requirements and the needs of your consumer base.

Orthodontist marketing is no various from various other companies in this respect. As your technique grows, so does your approaches of marketing right along with.

Added devices include: Google Analytics: A cost-free tool mounted to actively track website web traffic. Google Analytics lets you measure your marketing ROI in addition to track your Flash, video clip, and social networking websites and applications. Sitemap: A file that has all your website together so that internet search engine are able to understand your company.

Customizing: The perfect key phrases, videos, images and articles are all positioned to my response your site's demands. Visual web content is made to bring in further focus.

The Ultimate Guide To Orthodontic Branding

Having your rank endangered by an internet search engine's review would be devastating. You have to elevate your ranking and have your sites appearance approximately the proper standards. You are able to build your site from scratch to have an extra efficient electronic visibility. A more powerful electronic presence is feasible by having links organically contributed to the material of your site.

Any type of electronic advertising platform made use of is better used with directory site support. Look is vital in attracting patients who could quickly go searching someplace else.

The 9-Second Trick For Orthodontic Branding

Earnings boosts with destination, an eye-catching web site generates the income. By having specialized web links to social networks and educational websites the high quality and ease of access of your site dramatically boosts. On The Map Advertising and marketing functions to ensure that your orthodontist marketing project includes a great range links to the wider internet.

You will certainly require to make certain that your method has the neighborhood presence required to maintain the earnings it needs to endure (Orthodontic Branding). On The Map Advertising deals with you to maintain your position and get the placement you require to take into consideration growth. Let us assist you prepare for a long-term company technique

Logo designs in their simplest kind are simply an image that identifies an organization. When it comes to an orthodontic logo the majority of the pictures that enter your mind are a collection of straight grinning teeth, or teeth covered in braces, or a single tooth with some clever design. Although these are terrific pictures that completely represent the solutions used in any method, it is also important to make your orthodontist logo design stick out.

About Orthodontic Branding

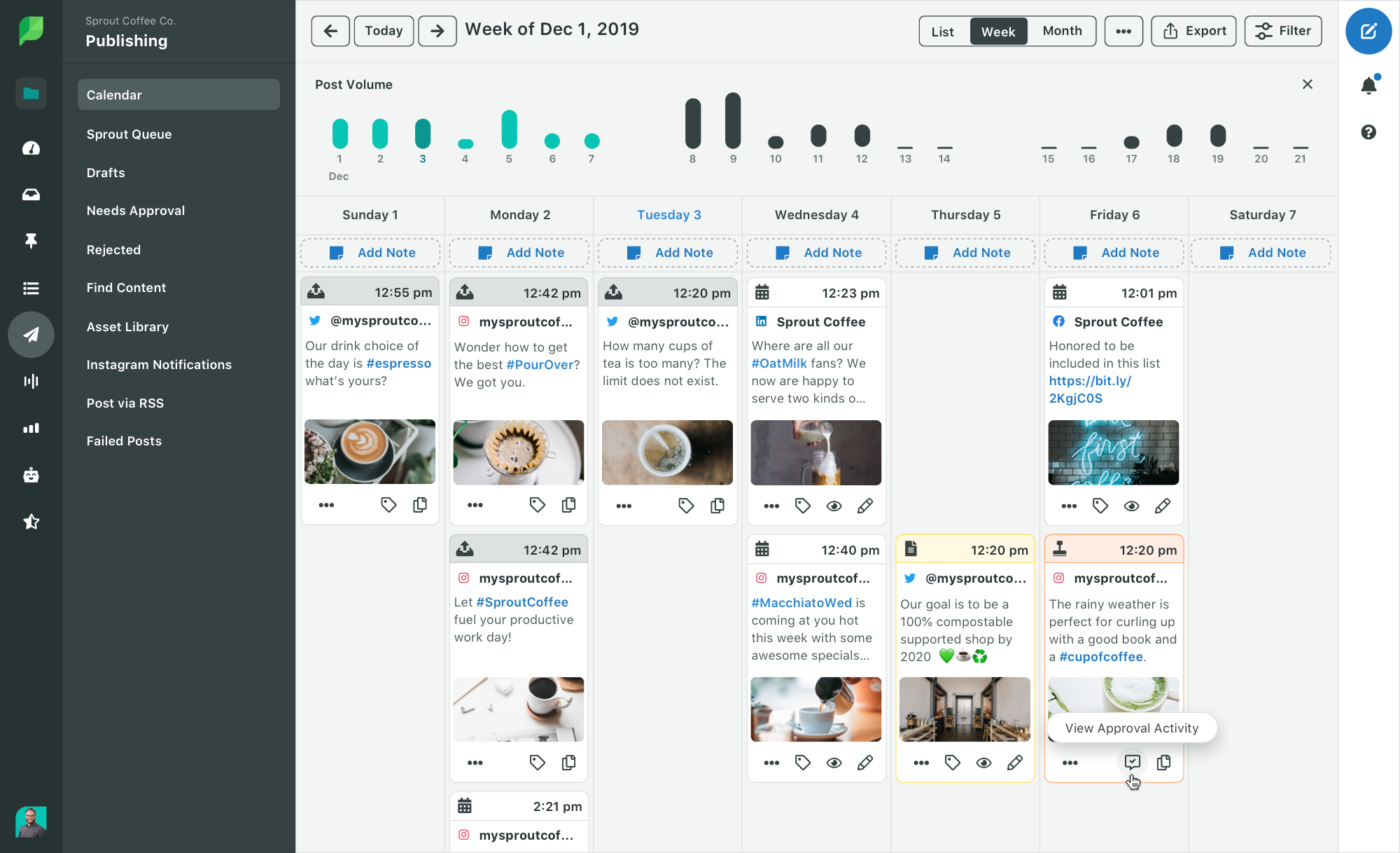

Purpose for 1 or 2 posts per day, and make sure they are top quality and useful for your followers. Orthodontic Branding. Making your why not try this out blog posts involving. Use images, video clips, and message to make your articles interesting and visually enticing. Utilizing hashtags. Hashtags are a fantastic way to get in touch with various other users who are interested in the same topics as you.

You can take good pictures with your mobile phone if you keep a few points in mind. Remember that all-natural or warm illumination is the most lovely. See to it you do not overexpose your pictures, which will certainly rinse your people and make it hard to value your oral work. Do imp source not make use of an active background, which will sidetrack from the client in the picture.